AR Pay: The Complete Financial Suite for Modern Aesthetic Practices

AR Pay is a fully-integrated financial suite that powers practice growth and delivers revenue intelligence as you scale. It lives natively inside Aesthetic Record, eliminating third-party integrations and giving your team a single, seamless experience for every payment type.

From Startup to Scale, We’re Built for Every Stage.

See how AR powers your next move.

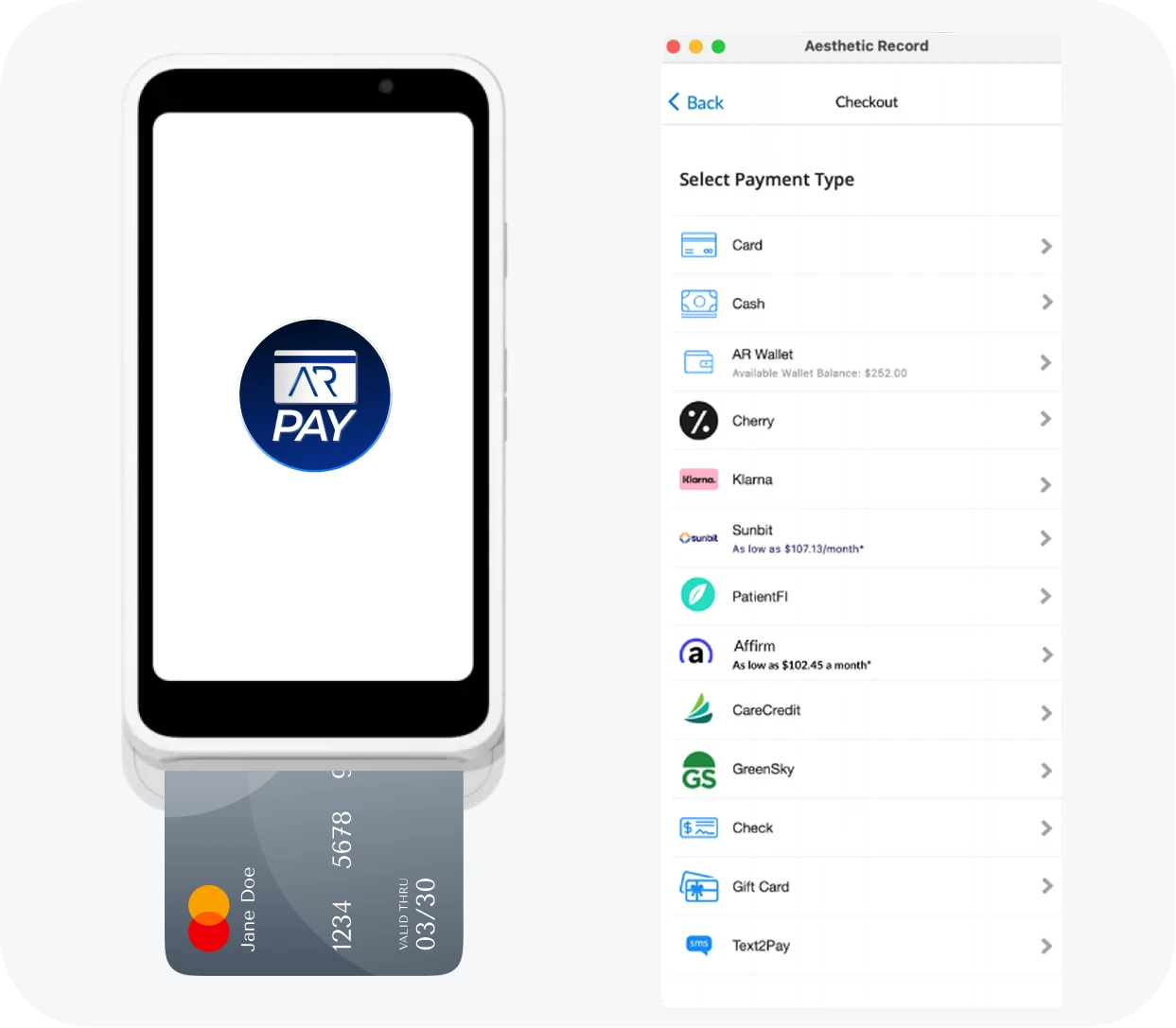

A Simpler Way to Collect Payments

AR Pay makes checkout effortless by allowing your team to collect payments directly inside your EMR. Whether patients pay in person, online, or via text, every transaction is fast, secure, and automatically reconciled.

WiFi & Bluetooth Card Readers

Choose from various card reader options that work with desktop checkout and the iOS Provider App. Whether your in the clinic or on-the-go, taking payments is easy with our AR Pay readers.

Instant Bank Payments

Offer patients the option to pay with their bank account and lower your processing fees! Unlike traditional bank ACH, it’s verified instantly and at a reduced rate of 2.1% through Text2Pay.

Tap to Pay with iPhone

Turn your iPhone into a mobile payment terminal! From the iOS Provider App, you can allow patients to tap their card at checkout.

Text2Pay

Send secure SMS links so patients can pay remotely without sharing card details over the phone or use a Buy Now, Pay Later option.

Cards on File

Store payment methods securely with tokenized encryption to simplify recurring transactions and repeat visits.

Patient Financing Options

Aesthetic Record’s Patient Financing via AR Pay removes the financial barrier between wanting treatment and booking it. With options from Klarna, Affirm, PatientFi, Sunbit, and Cherry, your patients gain flexibility, your practice gains predictable revenue, and your team gains time back.

Sunbit

Ideal for everyday transactions, offering high approval rates and “buy now, pay later” flexibility even for patients with limited credit history.

Cherry

Designed for aesthetics, offering soft credit checks, fast approvals, and customizable term lengths so patients can invest in larger treatment plans with confidence.

PatientFi

PatientFi’s integration with ASPIRE means you can bundle financing discussions into your overall patient experience strategy — “Yes, you can pay monthly and still earn loyalty points!”

Klarna

Allow clients to pay for their treatments interest-free in 30 days, in 4 interest-free payments every 2 weeks, or in longer installments up to 36 months.

Affirm

Affirm’s Adaptive Checkout™ technology delivers personalized payment options that are tailored to each purchase—including flexible plans from 4 interest-free payments every 2 weeks to longer installments up to 36 months.

All your loyalty programs — all in one wallet.

Reward patients for their treatments without creating additional work for staff. From full integrations with ASPIRE, RepeatMD and Joya, to Evolus QuickConnect and Alle and Xperience wallet tracking, you can reconcile reward dollars on every invoice.

ASPIRE Galderma Rewards

Full integration for automatic point tracking and redemption inside the Patient Wallet.

Allē by Allergan

Apply earned certificates directly to invoices — no separate logins or portals.

Evolus Rewards QuickConnect

Redeem points instantly using AR’s QuickConnect to the Evolus Rewards portal.

Merz Xperience

JOYA Health

Track annual benefits and prepaid services directly in the wallet for easy redemption.

RepeatMD

Integrate memberships and loyalty rewards so patients can earn and redeem seamlessly.

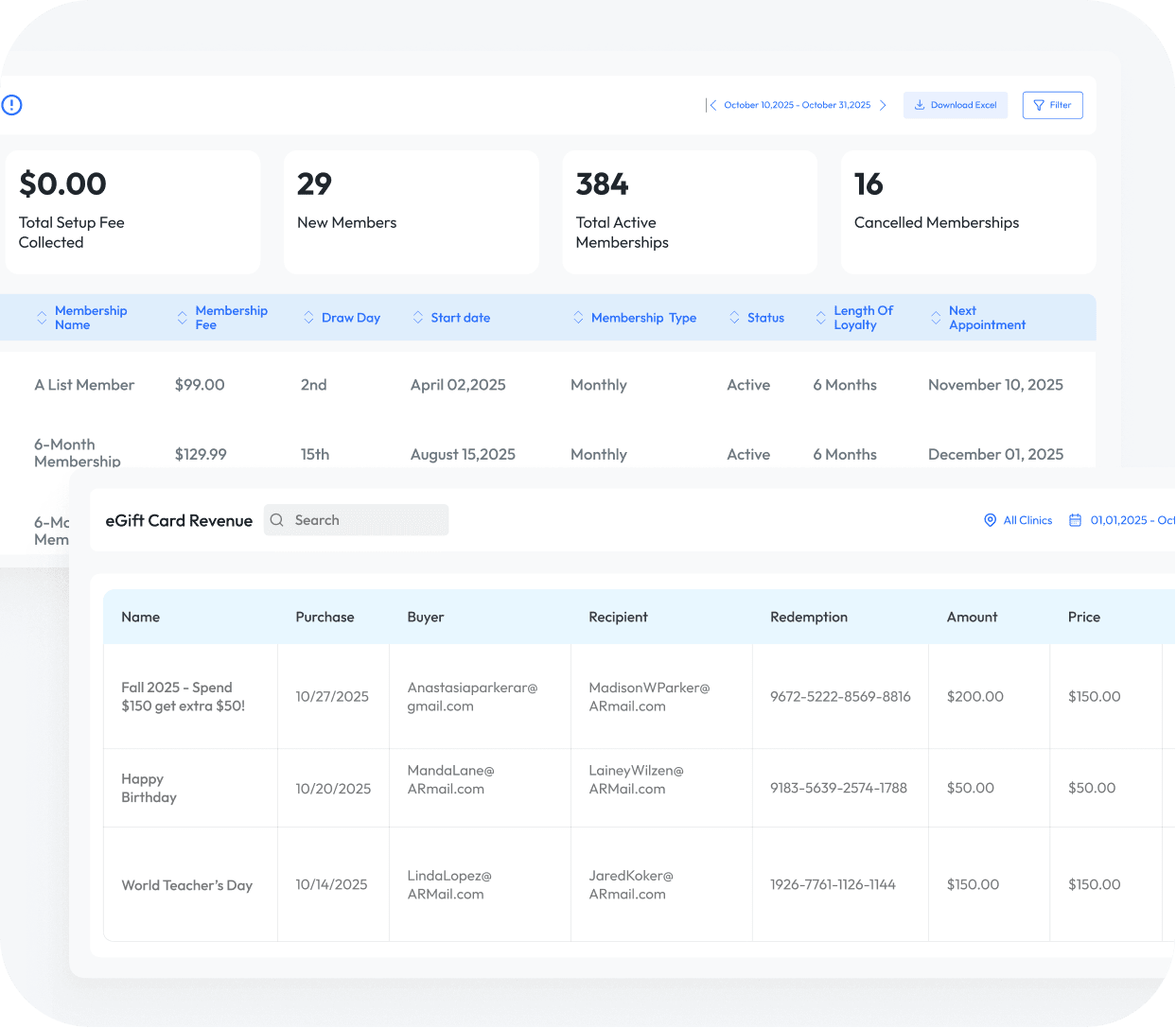

Automate Revenue Protection And Retention.

Service Deposits

Collect deposits upfront to secure appointments and reduce no-shows.

Packages & Pre-Payments

Create and store multi-treatment packages that can be redeemed over time.

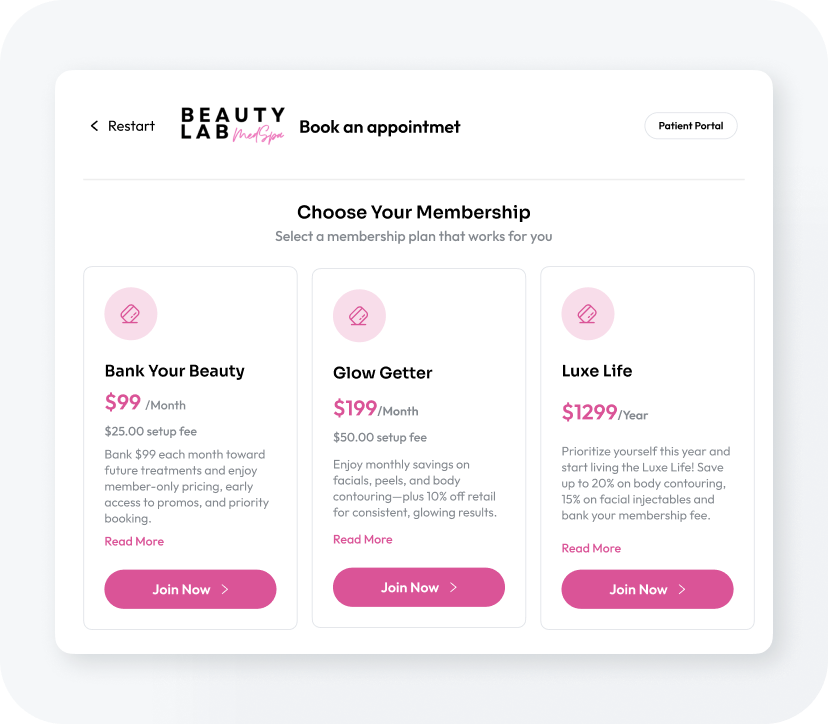

Memberships & Subscriptions

Automate recurring billing and wallet credits with tiered benefits.

Promotional Bundles

Offer BOGOs, seasonal packages, or service combinations stored in the wallet.

Chart-to-Cart Automation

Automatically pull documented treatments into checkout for accurate billing and fewer missed charges.

Cancellation Fees

Collect a credit card during booking to guarantee revenue and prevent no shows and cancellations.

Patient Wallet

A one-stop hub for credits, memberships, and loyalty points, giving patients control and your staff visibility at checkout.

eGift Cards

Sell, track, and redeem digital gift cards directly through your eCommerce site or POS.

Your financial data — working for you.

Every AR Pay transaction feeds directly into your Business Insights dashboard for complete visibility. Track provider performance, payment trends, and patient spend to uncover new opportunities, optimize pricing, and grow smarter — not harder.

Revenue Tracking

Analyze performance by provider, service, or location.

Payment Method Insights

See which payment types perform best and reduce processing costs.

Patient Spend Behavior

Identify high-value patients and tailor marketing strategies.

Wallet Liability Management

Track outstanding credits, memberships, and pre-purchases.

Payment Protection For Your Bottom Line

When you use AR Pay, you get the benefit of a single, streamlined data flow to improve accuracy and increase efficiency, but you also get additional protections that help you keep more of what you’ve earned.

Card Account Updater

Card numbers and expiration dates regularly change, and outdated card information is a common source of declines for online businesses. AR Pay uses the Card Account Updater offered by major card networks to improve acceptance by retrieving and updating saved card payment information automatically at no additional charge.

Early Fraud Warnings

When a payment is flagged as potentially fraudulent by the card brands, it is declined proactively saving you the headache of a future dispute.

Processing Rate Protection

The card brands all charge varying interchange fees on the credit cards they process. This depends on the type of card, debit or major credit card with rewards, for example, the card brand, and other factors. These fees can vary substantially from one transaction to the next. With AR Pay, your set rates are inclusive of all processing fees, regardless of interchange costs.

New Account Approvals

Dispute Management

Adaptive Acceptance

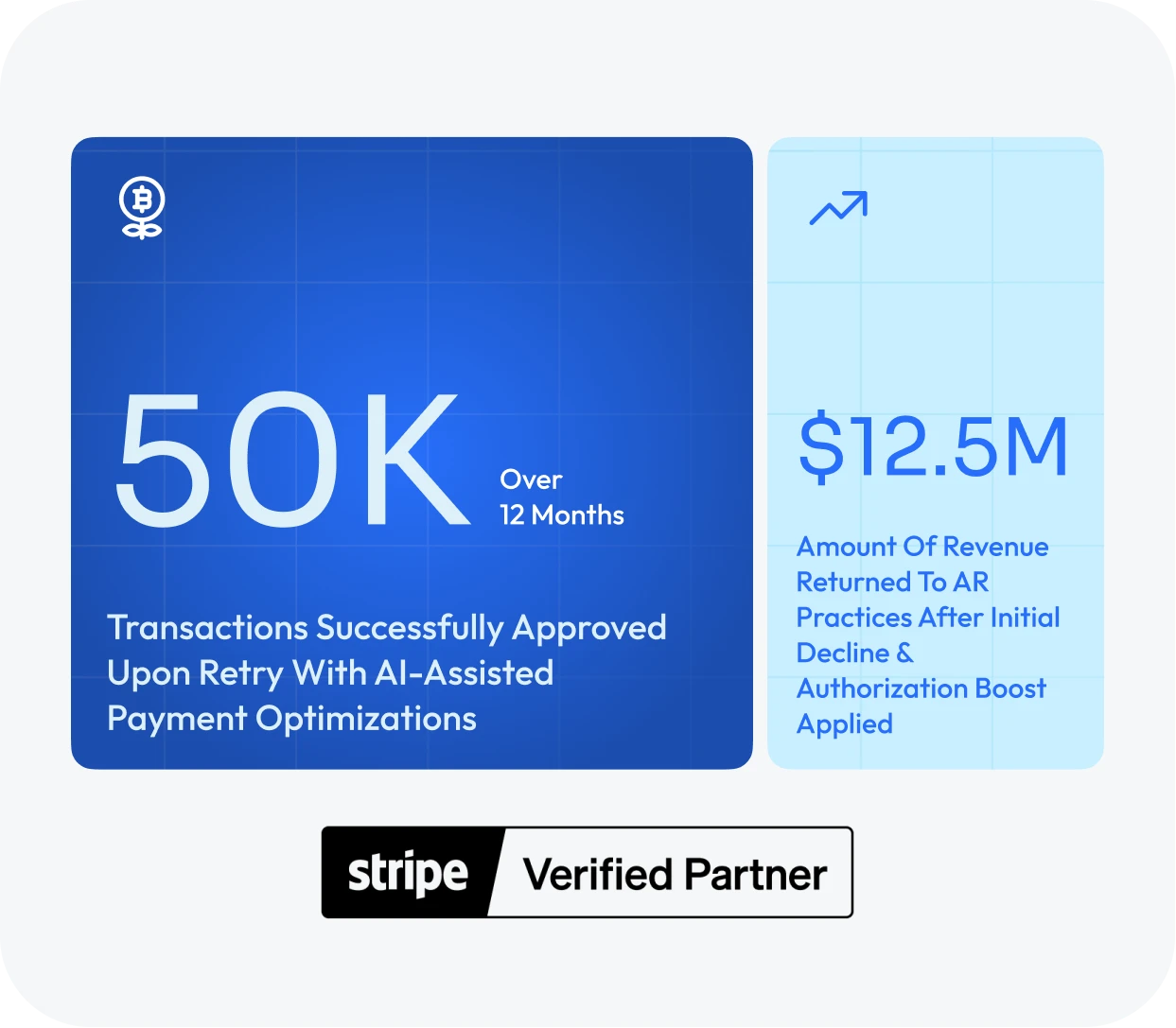

AR Pay partners with Stripe to boost authorizations for your Card Not Present transactions. This includes AI-driven payment optimizations that help format transactions for better approval rates. Over a 12 month period, AR Pay will authorize 50,000 previously declined transactions resulting in $12M more dollars to Aesthetic Record users’ bottom line.

See AR Pay in Action

Built to Support Every Stage of Your Aesthetic Journey.

Book a demo and experience the difference.